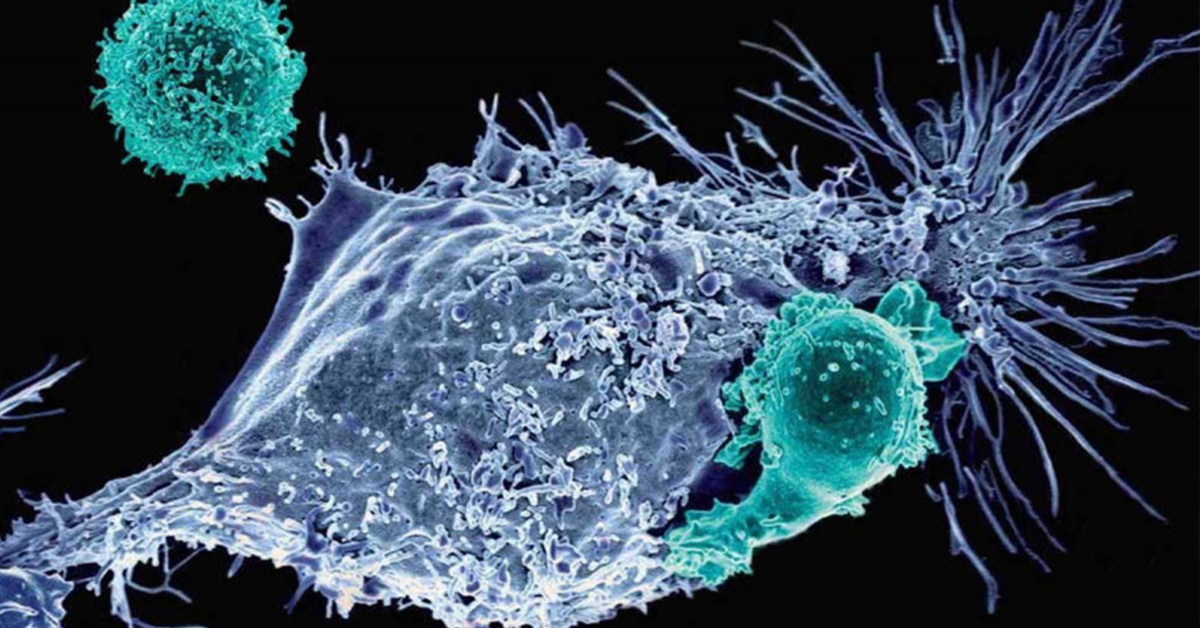

Spurred by CMS’s decision to cover CAR-T cell therapies under Medicare, commercial payers are beginning to systematize approvals for CAR-T treatment as use of these breakthrough cancer therapies is beginning to ramp up. Precision’s Dan Danielson weighs in on factors driving authorizations now and what to expect as more CAR-T therapies are approved.

Payers Create CAR-T Approval Systems as Adoption Increases

Spurred by CMS’s decision to cover chimeric antigen receptor T-cell therapies under Medicare, commercial payers are beginning to systematize approvals for CAR-T treatment as use of these breakthrough cancer therapies is beginning to ramp up, experts say.

“Despite the costs of CAR-T, I know many plans were already looking at providing coverage prior to the CMS decision,” which was released in October 2019, says Dan Danielson, R.Ph., senior director of the access experience team at PRECISIONvalue. “CMS’s decision provided confirmation that they were on the right track,” he tells AIS Health, a division of MMIT.

Following the CMS changes, many health plans subsequently updated their medical necessity guidelines around T-cell therapies, adds Ashraf Shehata, national sector lead for life sciences at KPMG.

Case History Will Drive Authorizations

“There’s probably some space between case-by-case approvals and what I would call process-based approvals,” Shehata tells AIS Health. “They still need quite a bit of documentation. They have to make sure that the person has no prior treatment with CAR-T, proper organ function, no active infection, no history of allergies around stem cell transplant. And then we’ve seen a lot more visibility on the approvals of the treatment facility itself. Those parts of the process have been much more consistent.”

In addition, plans are communicating about the process more effectively to providers and to members, Shehata says. “Is it case-by-case? It is, but the criteria is much better defined and laid out much more clearly under each therapy program.”

“It appears that payers have instituted policies with specific criteria based on the product label for CAR-T therapies,” says Danielson. “While the basic clinical criteria for CAR-Ts are similar, there may be differences among them. For example, some policies specify that the patient will be treated at a certified treatment center, while others do not. This requirement may be more of a formality because the biopharmaceutical companies who make the CAR-T therapies have their own network of certified institutions that can access these therapies.”

As with authorization for other cancer therapies, providers need to submit documentation about the patient’s current clinical condition and previous therapies received, Danielson says. “They will also need to demonstrate that the patient has adequate organ and bone marrow function to produce sufficient T-cells for the treatment,” he says. “Selection of a specific treatment center for the patient may be guided by the payer in collaboration with the patient’s oncologist.”

Present Utilization Isn’t a Financial Risk

Overall utilization of CAR-Ts right now isn’t high enough to be a major cost concern for payers, says Jay Jackson, principal at Avalere Health. However, as more CAR-T therapies come on the market and use ramps up, “at that point you might see a little tighter management,” Jackson tells AIS Health.

Still, he says, “as long as the diagnosis is appropriate,” payers should approve treatment. The clinicians who administer CAR-T infusions also are looking at whether they possibly can be performed on an outpatient basis, which potentially would reduce some of the cost associated with the treatments, Jackson says.

Five CAR-T therapies currently hold FDA approval for treating forms of lymphoma, leukemia and multiple myeloma. In addition, the CAR-T pipeline is rich, with drugs in dozens of clinical trials targeting multiple different types of both blood cancers and solid tumors, meaning the treatments are highly likely to become much more common in coming years.

Yescarta (axicabtagene ciloleucel) from Kite Pharma, Inc., a Gilead Sciences, Inc., company, and Kymriah (tisagenlecleucel) from Novartis Pharmaceuticals Corp. were the first two CAR-T therapies on the market. Kymriah was approved in August 2017, and is intended for adults with relapsed or refractory diffuse large B-cell lymphoma and for young adults up to age 25 with relapsed or refractory acute lymphoblastic leukemia.

Number of Approvals Increases

Meanwhile, Yescarta was first approved in October 2017, and now holds approvals for diffuse large B-cell lymphoma, primary mediastinal B-cell lymphoma, high grade B-cell lymphoma, diffuse large B-cell lymphoma that results from follicular lymphoma, and follicular lymphoma.

Three more CAR-T therapies since have been approved and entered the market. Bristol Myers Squibb’s Abecma (idecabtagene vicleucel), for adult patients with relapsed or refractory multiple myeloma after four or more prior lines of therapy, including an immunomodulatory agent, a proteasome inhibitor, and an antidCD38 monoclonal antibody; Bristol Myers Squibb’s Breyanzi (lisocabtagene maraleucel), for adult patients with relapsed or refractory large B-cell lymphoma after two or more lines of systemic therapy; and Kite’s Tecartus (brexucabtagene autoleucel), for patients with relapsed or refractory mantle cell lymphoma.

The process of administering CAR-Ts is complex and involves extracting a person’s T-cells, shipping them to a facility where they are genetically reprogrammed, and then infusing them into the patient. Patients must stay near their infusion facility for a period of time afterward to be monitored for any adverse reactions, such as cytokine release syndrome and neurological toxicities.

Last fall, CMS finalized changes to how CAR-T will be reimbursed under fee-for-service, creating a new Medicare Severity Diagnosis-Related Group (MS-DRG) for CAR-T treatment stays at the hospital, with differential reimbursement based on whether the product was provided as part of a clinical trial. CMS also discontinued add-on payments for CAR-T.

Payment by CMS Will Be Predictable

In 2021, CMS will pay $432,707 to hospitals for CAR-T treatments that are not part of clinical trials, and $50,985 to hospitals for CAR-T treatments that are part of clinical trials, since the drug is supplied as part of the trial. The policy changes increased payment predictability for CAR-T, although “the overall financial impact will vary by hospital…and reimbursement may fall short of fully recognizing provider costs of treatment in many cases,” according to an Avalere analysis.

“Stakeholders should consider how these policies could impact other payer markets and the emerging pipeline of high up-front cost cell or gene therapies,” the analysis added.

As more CAR-T therapies are approved, Shehata says he expects more collaboration with centers of excellence, which would work directly with manufacturers to coordinate treatment.

Next, he says, the CPT codes will be refined and will become more aligned with the sub-therapies: “Each FDA-approved product will have a series of clinical diagnoses codes. These are going to be much more refined over the next several years, so there will be a little less guesswork on the claims and prior authorization process.”

Finally, as more data are gathered on patient outcomes with CAR-T therapies, “trust is built with the academic medical centers that are delivering many of these therapies,” Shehata says. “I think at the end of the day, that’s going to mean a much more streamlined prior authorization process,” he adds.

In the early days of CAR-T therapy, cytokine release syndrome was a major, serious side effect, and was of great concern to payers, Danielson says. However, oncologists quickly learned how to manage this and other serious side effects.

Some Cases Are Too Severe for CAR-T

“In terms of determining who may benefit most from this treatment, that is what patient selection criteria attempt to address,” Danielson says.

“However, for some, the odds of benefit are not great, simply due to their cancer. For example, we see high failure rates in those with relapsed/refractory diffuse large B-cell lymphoma, with almost half suffering relapses shortly after receiving CAR-T therapy. There is active research seeking to determine why these failures happen, but at this point, much is unknown.”

Because CAR-T is still so new, the use of value-based agreements with such drugs will likely take place well in the future, as plans work to develop enough experience with them, Danielson says.

“While the process for patient selection, administration of therapy, and monitoring ultimate cost of therapy may be conducive to developing a VBC [value-based agreement] based on medium- to long-term outcomes, I think many payers remain hesitant,” Danielson says.

“In the commercial insurance space, patients will move out of the plan typically over the course of two to three years. This presents some very real logistical issues for tracking patients over time,” Danielson adds.

“I suspect that more payers are looking at how to mitigate costs associated with near-term treatment failures — within one year — where the CAR-T therapy ‘doesn’t take’ for price relief,” he says.

Value-Based Agreements May Be Coming

Shehata says he hasn’t seen value-based arrangements yet for CAR-T, but that could change.

He notes that years ago, some in the industry thought it would be difficult or impossible to create value-based care programs within oncology, because it was so complex, “yet here we are, we’re seeing oncology as one of the areas that has been quite successful with value-based therapy.”

The data being collected for CAR-T therapies will be “very enabling” for risk-based arrangements, Shehata adds, although more needs to be collected.

Contact Danielson via Tess Rollano at trollano@coynepr.com, Shehata via William Borden at wborden@kpmg.com and Jackson via Claire Anderson at claire.anderson@finnpartners.com.

by Jane Anderson